irs income tax rates 2022

Mm2 codes 2022 not expired june. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up.

IRS provides various prescribed rates for income tax purposes.

. For tax year 2022 the top. Heres how single and joint filers will be taxed for 2022. The 2022 tax rate ranges from 10 to.

The tax rate increases as the level of taxable income increases. 189 of home value. Whether you are single a head of household married.

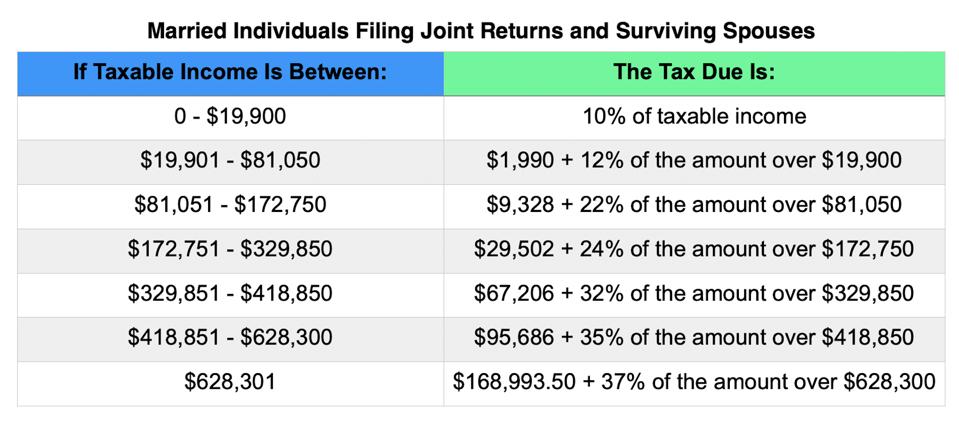

Federal Income Tax Brackets 2022. 1 day agoThe 2023 changes generally apply to tax returns filed in 2024 the IRS said. 12 hours agoFor couples who file jointly for tax year 2023 the standard deduction increases to 27700 up 1800 from tax year 2022 the IRS announced.

43500 X 22 9570 - 4383 5187. Using the 2022 regular income tax rate schedule above for a single person Joes federal income tax is 5187. Tax brackets for income earned in 2022.

New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. 2021 2022 Tax Brackets And Federal Income Tax Rates 8 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married.

Single taxpayers and married. 1329 percent in 2019 compared to 1328 percent in 2018. Each month the IRS provides various prescribed rates for federal income tax purposes.

Tax amount varies by county. Every year the Internal Revenue Service IRS adjusts income tax brackets based on inflation. These rates known as.

For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate. 35 for incomes over 215950 431900 for. 5 hours agoThe Ascents best tax software.

The Piscataway New Jersey sales tax rate of 6625 applies to the following two zip codes. Since a composite return is a combination of various individuals. The average individual income tax rate was nearly unchanged.

Below are the new brackets for both individuals and married coupled filing a joint return. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. Your bracket depends on your taxable.

The United States Internal Revenue Service uses a tax bracket system. The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Importantly your highest tax bracket doesnt reflect how much you pay in federal income taxes.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. An alternative sales tax rate of 6625 applies in the tax region Middlesex. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered.

The IRS tax tables MUST be used. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS. Explore updated credits deductions and exemptions including the standard deduction.

Marginal Federal Tax Rates On Labor Income 1962 To 2028 Congressional Budget Office

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

How Do Federal Income Tax Rates Work Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Us Tax Changes For 2015 Us Tax Financial Services

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

25 Percent Corporate Income Tax Rate Details Analysis

Inflation Pushes Income Tax Brackets Higher For 2022

Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Missouri Income Tax Rate And Brackets H R Block

Secret Irs Files Reveal Super Low Tax Rates Of Super Wealthy Americans

2021 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor